Home / Health Insurance / Articles / Individual Health Insurance / Individual Health Insurance Cost: Premium Factors and Ways to Save

Individual Health Insurance Cost: Premium Factors and Ways to Save

Roocha KanadeDec 11, 2025

Share Post

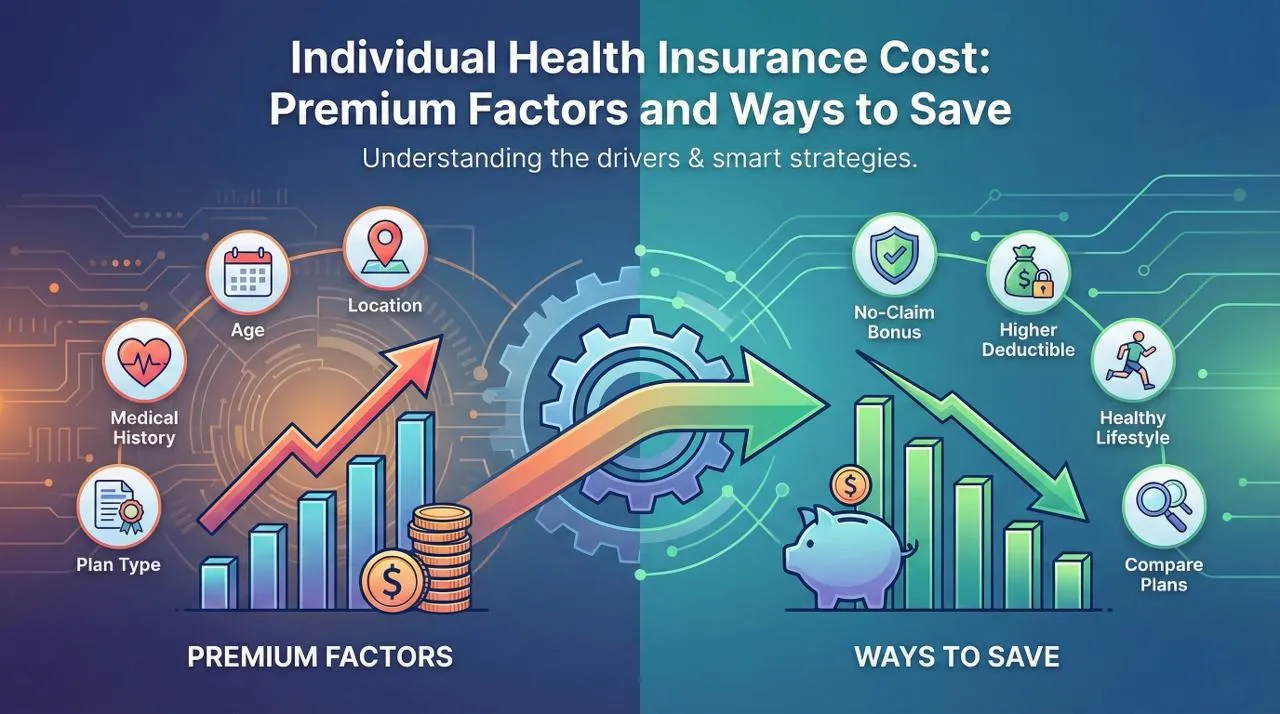

The cost of individual health insurance simply refers to the premium you pay for your personal health cover. This amount can vary quite a bit from person to person because insurers consider different risk factors before deciding your premium. Your age, medical history, lifestyle choices, and even the coverage you select can nudge the cost up or down.

Think of it as a customised price based on your health profile and the level of protection you want. The good news is that you have more control over this cost than you might think. Small choices can make a noticeable difference. Let's examine what affects your premium and how you can reduce the cost without compromising on coverage.

Contents

What Determines the Cost of Individual Health Insurance?

Every insurer has its own way of calculating premiums, but the idea behind it is the same. Your individual health insurance cost is influenced by a mix of personal factors like age, health profile, lifestyle habits, and the type of coverage you choose. Insurers check how likely you are to file a claim and how much it may cost them, and then decide your premium based on that risk. This is why two people of the same age may still get different quotes. Even small details, like your city, your health status, or your past medical conditions, play a part in shaping the cost.

Key Factors Affecting Your Individual Health Insurance Premium

Your individual health insurance cost is influenced by a mix of personal factors like age, health profile, and lifestyle habits. Here is a list of key factors that affect your individual health insurance premium.

1. Age and Life Stage: Your age is one of the strongest predictors of your premium. Younger people generally pay less because they have a lower chance of developing medical issues.

For example, a 25-year-old might pay significantly less than a 45-year-old for the same coverage. As you grow older, the risk of lifestyle diseases and hospital visits increases, and so does your premium amount.

2. Pre-existing Diseases and Medical History: If you already have certain medical conditions or a history of recurring illnesses, your premium may be higher. This is because insurers expect a greater likelihood of claims. Even small health issues can make a difference.

3. Sum Insured (Coverage Amount): A higher sum insured gives you a wider safety net, especially with rising healthcare costs. However, a larger cover naturally comes with a higher premium. The key is to choose a sum insured that feels realistic for your needs, not too low, not unnecessarily high.

4. Lifestyle Habits such as Smoking, Alcohol Intake, and BMI: Your lifestyle plays a surprisingly big role. Smokers, heavy drinkers, or people with a high BMI may be offered higher premiums because these habits increase long-term health risks. Staying healthy does not just feel good; it literally helps you save money on your premium.

5. City, Location, and Local Healthcare Costs: Where you live also influences your premium. Healthcare costs in metro cities tend to be higher than those in tier-2 or tier-3 cities, and your premium often reflects this difference.

6. Add-on Covers and Riders: If you add riders like maternity cover, critical illness cover, or personal accident cover, your premium will increase because you are adding more protection. These add-ons can be useful, but they do raise the cost.

How to Lower Your Individual Health Insurance Premium

Here are some tips to lower your individual health insurance premium.

Buy Individual Health Insurance Early

Premiums are at their lowest when you are young and healthy. Early buying also helps you get through waiting periods sooner. It is simply the most cost-effective stage of life to buy insurance.

Choose an Optimal Sum Insured

You do not need the highest coverage available. You just need the right one. Factors like your age, family medical history, and hospitalisation costs in your city can help you decide. Overbuying leads to unnecessary expenses; underbuying reduces your protection.

Opt for Higher Deductibles or Co-pay Options

If you are comfortable paying a small amount during claims, opting for a higher deductible can bring down your premium. Co-pay features also work similarly. These are good options for people who want lower premiums and are okay sharing a part of the cost when needed.

Maintain a Healthy Lifestyle

A tobacco-free lifestyle, moderate alcohol consumption, and regular exercise all work in your favour. These habits reduce your chances of lifestyle diseases, which helps insurers view you as low-risk. That often translates into a better premium.

Renew on Time and Avoid Lapses

Timely renewals protect your No-Claim Bonus and ensure your policy does not lapse. If your policy expires, your premium may go up, and you may need to restart waiting periods.

Common Mistakes That Increase Your Individual Health Insurance Cost

People often end up paying more for their health insurance because of simple, avoidable mistakes. A few common ones include:

Buying a policy too late: Premiums steadily increase with age, so delaying your purchase can make your future costs much higher.

Adding unnecessary riders: Riders like critical illness or maternity cover can be useful, but choosing add-ons you do not actually need will only push your premium up.

Skipping or delaying renewals: Missing your renewal date can lead to policy lapses, loss of benefits like No-Claim Bonus, and a higher premium when you reapply.

Avoiding these mistakes can help you save significantly over time.

Conclusion

Your individual health insurance cost depends on many things: your age, your coverage amount, your medical history, and the lifestyle choices you make. Once you understand how these factors work, it becomes much easier to pick a plan that fits your budget without cutting down on important benefits. The goal is simple: stay protected and save more over time. Understanding what drives your premium helps you choose wisely and save more over time.

Frequently asked questions

Here are some common questions and answers on Individual Health Insurance Cost: Premium Factors and Ways to Save

What factors affect the cost of individual health insurance?

Your age, medical history, lifestyle habits, sum insured, and add-on covers all influence your premium.

Can I reduce my health insurance premium without reducing coverage?

Yes. Buying early, choosing the right sum insured, maintaining a healthy lifestyle, and avoiding unnecessary riders can help.

Does age affect my premium amount?

Yes, the premiums tend to be lower when you are younger and increase as you grow older.

Is there a tax deduction on my premium?

Yes, you can claim tax benefits under Section 80D on your health insurance premium.

Recent

Articles

What Does Individual Health Insurance Cover and Exclude

Roocha Kanade Dec 11, 2025

Eligibility Criteria for Individual Health Insurance in India

Roocha Kanade Dec 11, 2025

Individual Health Insurance Cost: Premium Factors and Ways to Save

Roocha Kanade Dec 11, 2025

Family Health Insurance vs Individual Health Insurance: Key Differences

Roocha Kanade Dec 10, 2025

Why Should Every Woman Have an Individual Health Insurance Plan?

Roocha Kanade Dec 10, 2025

All Articles

Want to post any comments?

Discover our diverse range of Health Insurance Plans tailored to meet your specific requirements🏥

✅ 100% Room Rent Covered* ✅ Zero deductions at claims ✅ 7100+ Cashless Hospitals

Check health insurance