ACKO Life’s Philosophy: Pure Protection, Unmixed

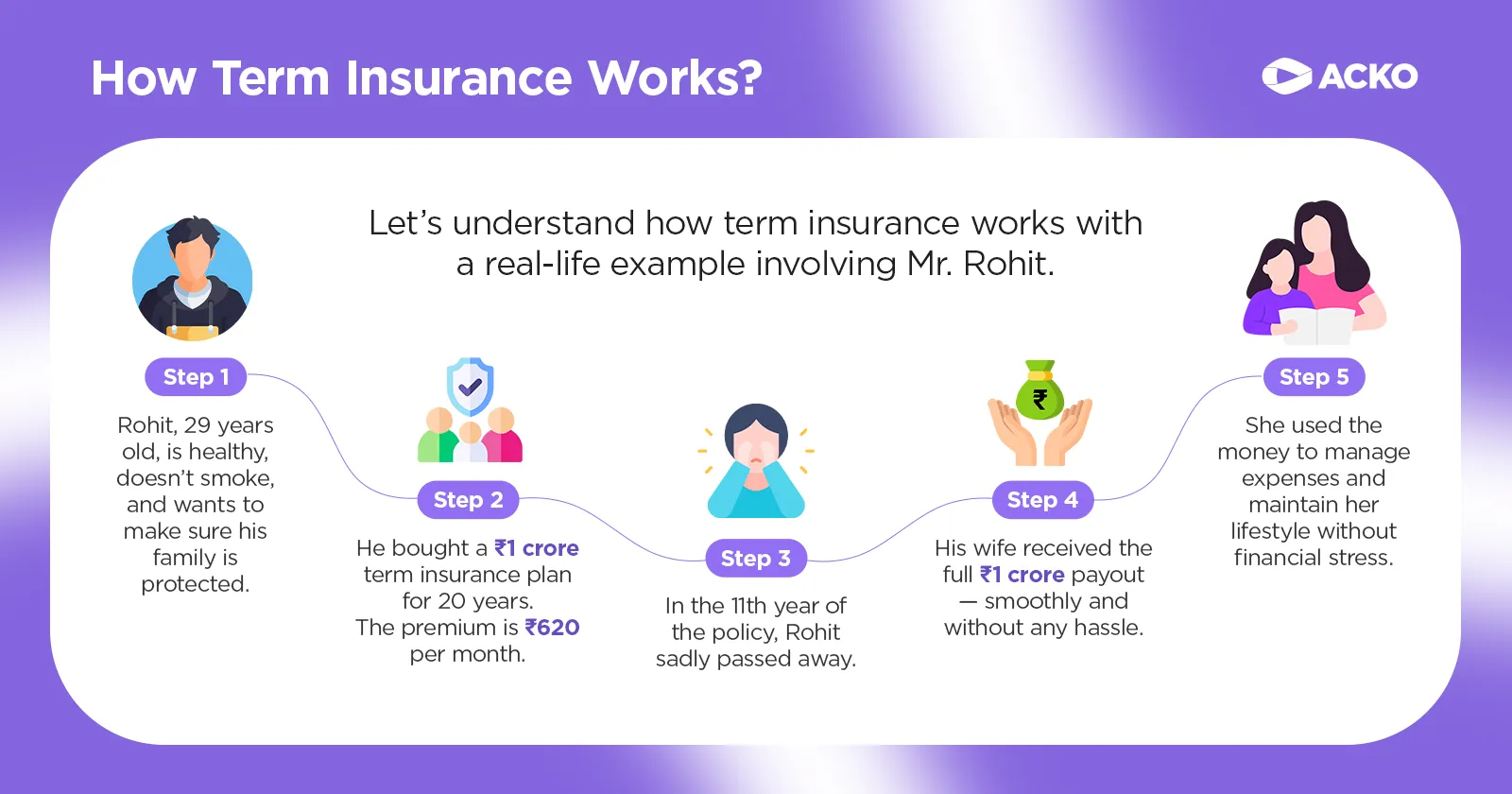

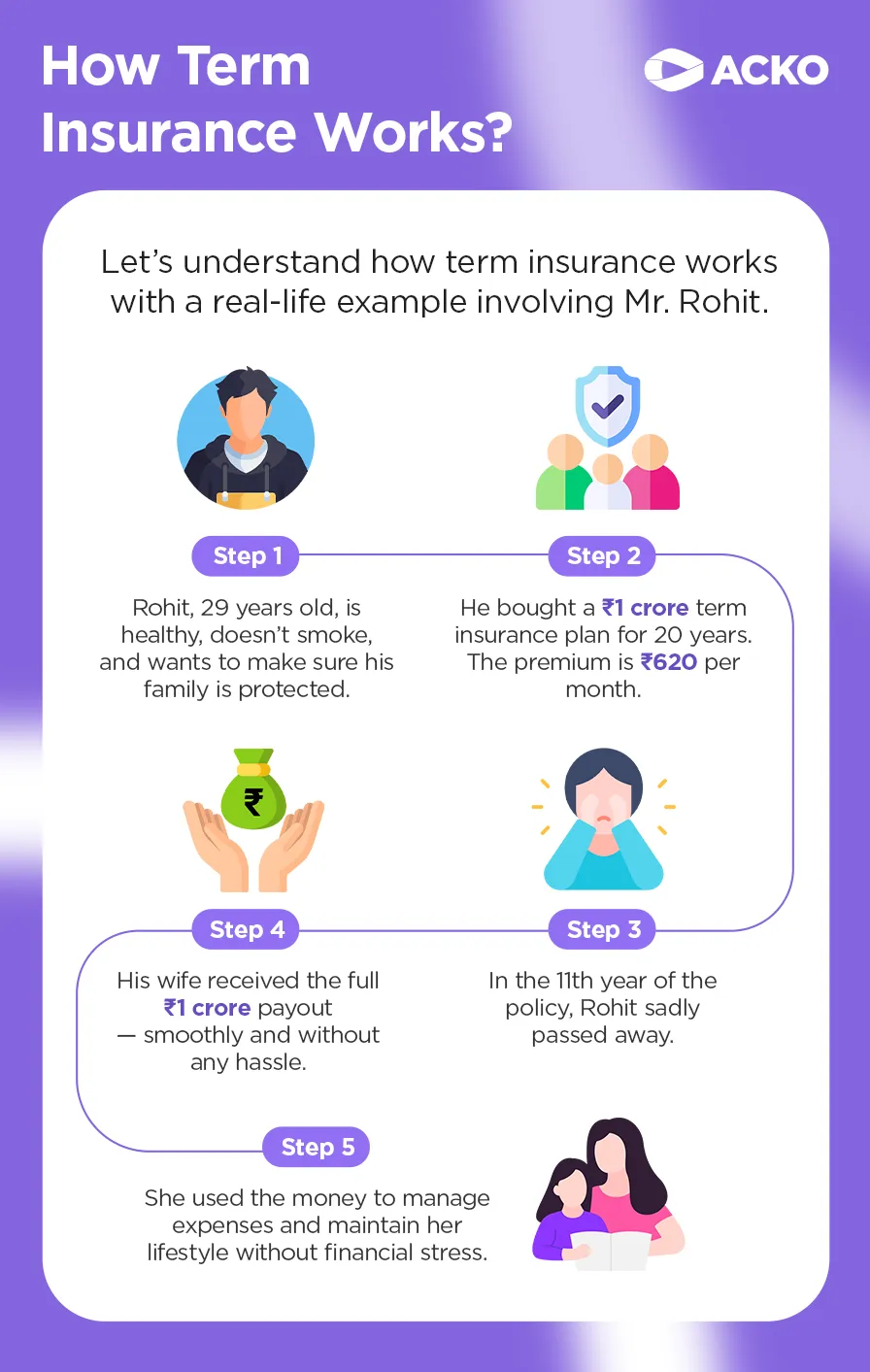

At ACKO Life Insurance, we believe life insurance should do one thing well: protect your family financially in case you are not around. It stands between uncertainty and your family’s financial security. That’s why ACKO Life’s sole focus is on providing straightforward life protection, without any hidden agendas. We offer only term life insurance, built purely to do what life insurance is meant to do: protect.

While many life insurance products combine protection with savings or investments, we keep term insurance clear and purpose-driven, so its role is never diluted. By separating life insurance from complicated investments, we deliver transparent and genuine value. This protection is easy to understand, affordable to maintain, and dependable when families need it most.